Structuring the Fund and Management Entities for a U.S. Fund

In forming a U.S. private fund structure, you will need to determine, among other things, whether you wish to employ a “2-entity” or “3-entity” structure. Since a Delaware limited partnership (which serves as the entity of choice for most U.S. funds) will always need to have a general partner (usually another LLC), a U.S. private fund structure will always have at least 2 entities. Whether you wish to form a third entity to serve as the “investment manager” to the Fund, depends on various factors, which we have endeavored to outline below.

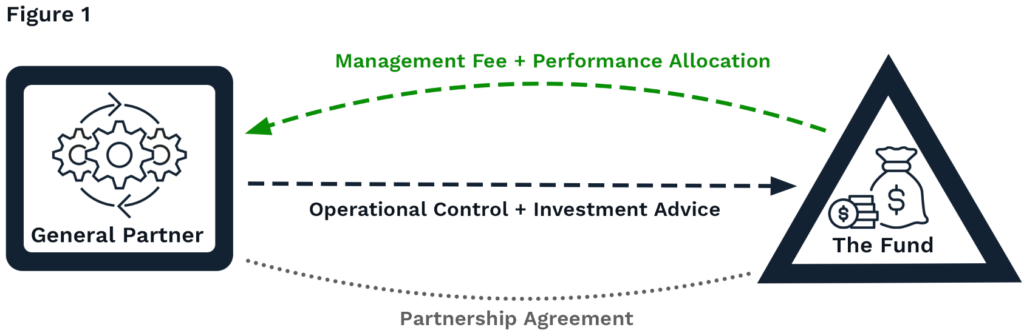

2-entity Structure – Without Separate Investment Manager

Figure 1 below shows the 2-entity structure. This structure consists of a Delaware limited partnership as the “Fund” and a separate limited liability company to serve as both the “General Partner” and “Investment Manager” of the Fund. The General Partner operates the fund and handles the investment management function under a broad grant of authority under the Fund’s partnership agreement.

In considering whether a 2-entity structure is right for your fund setup, consider the pros and cons of the 2-entity structure described below.

Pros of the 2-entity Structure

The 2-entity structure offers a simple setup option with one less entity to look after. It also offers cost savings in respect of lower annual expenses to maintain the management entities and lower accounting fees relative to those required for a third management entity in the 3-entity structure.

Cons of the 2-entity Structure

Relative to the 3-entity structure described below, the 2-entity structure does not offer as much flexibility to structure equity compensation or revenue share deals with key employees, anchor investors, or other strategic partners.

If you will advise separate managed accounts (in addition to the Fund) or more than one fund product, the 2-entity structure does not segregate liabilities as well as possible in the 3-entity structure, which utilizes a separate Investment Manager entity (see description of this liability concept under the 3-entity structure discussion).

Finally, in jurisdictions that assess an Unincorporated Business Tax, the 2-entity structure is not as tax-efficient as the 3-entity structure.

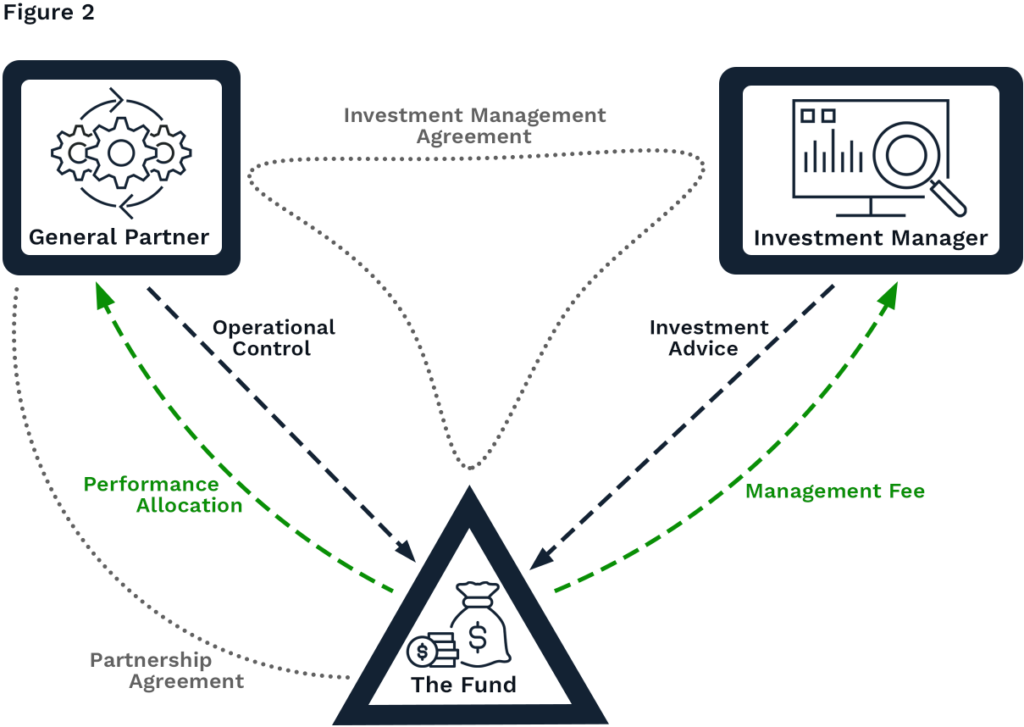

3-Entity Structure – Utilizing a Separate Investment Manager

Figure 2 below shows the 3-entity structure. This structure consists of a Delaware limited partnership as the “Fund” and two (2) separate companies (usually LLCs) to serve as the “General Partner” and “Investment Manager” of the Fund, respectively. In this structure, the General Partner handles the Fund’s operations and delegates the investment management function to the Investment Manager.

In considering whether a 3-entity structure is right for your fund setup, consider the pros and cons of the 3-entity structure described below.

Pros of the 3-entity Structure

The 3-entity structure offers the potential for tax savings in New York City, Texas, and other jurisdictions that assess an Unincorporated Business Tax (“UBT”) such that, if structured properly, UBT can be avoided on the profits of the General Partner entity.

Regardless of location, the 3-entity structure also offers greater flexibility in structuring equity compensation arrangements, revenue share deals, and other incentive programs with key employees, anchor investors, and strategic partners.

Also, the 3-entity structure better segregates liabilities for investment managers with multiple product offerings. That is, the 3-entity structure better protects accumulated performance allocations from the Fund, since investors in separate managed accounts or in another private fund won’t have a relationship with the General Partner (which would only serve as the General Partner to a given fund).

Finally, it should be said that the 3-entity structure is preferred by most large asset management organizations and, in this way, does appear somewhat more “institutional.”

Cons of the 3-entity Structure

The cons of the 3-entity structure include the additional complexity and costs associated with maintaining the third entity. These costs generally consist of the entity maintenance costs owed to the state authorities where the entity is formed or operated and the cost of tax services (e.g., tax preparation expenses) related to the separate Investment Manager entity.

Because the separate Investment Manager operates under a delegation of authority from the General Partner, the 3-entity structure does add a bit of complexity when it comes to transacting business through the management entities, signing documents, and otherwise executing business operations. However, most of our clients operating in the 3-entity structure get comfortable with the relative roles of the management entities such that the extra management entity does not add undue complexity on a day-to-day basis.

Conclusion

You will need to consider whether the 2-entity structure or 3-entity structure is right for your private fund setup. In some cases, specific operational or tax circumstances dictate a more complex structure. Please let us know if you have questions as you consider how to setup your U.S. fund.